does california have real estate taxes

California residents dont need to worry about a state inheritance or estate tax as its 0. Property tax in California is calculated by something called Ad Velorum.

Column A Tax On High End Real Estate Sales Is Gaining Steam Los Angeles Times

As of January 1 2020 California real estate withholding changed.

. Interestingly California has property taxes that are below the. There is no estate tax in California. We now have one Form 593 Real Estate Withholding Statement which is filed with FTB after every real estate transaction.

California Property Taxes Go To Different State 283900 Avg. Menu burger Close thin. California real property owners can claim a 7000 exemption on their primary residence.

The tax rate is 1 of the total. This reduces the assessed value by 7000 saving you up to 70 per year. However the state currently owes.

California tops out at 133 per year whereas the top federal tax rate is currently 37. California estates must follow the federal estate tax which taxes certain large estates. You can pro-rate any unpaid property taxes with your buyer until you finish the escrow on the house sale.

Even though California wont ding you with the death tax there are still estate taxes at. 074 of home value Tax amount varies by county The median property tax in California is 283900 per year for a. Because the California estate tax exemption is 549 million two out of every 1000 people who pass away will be taxed by the federal government.

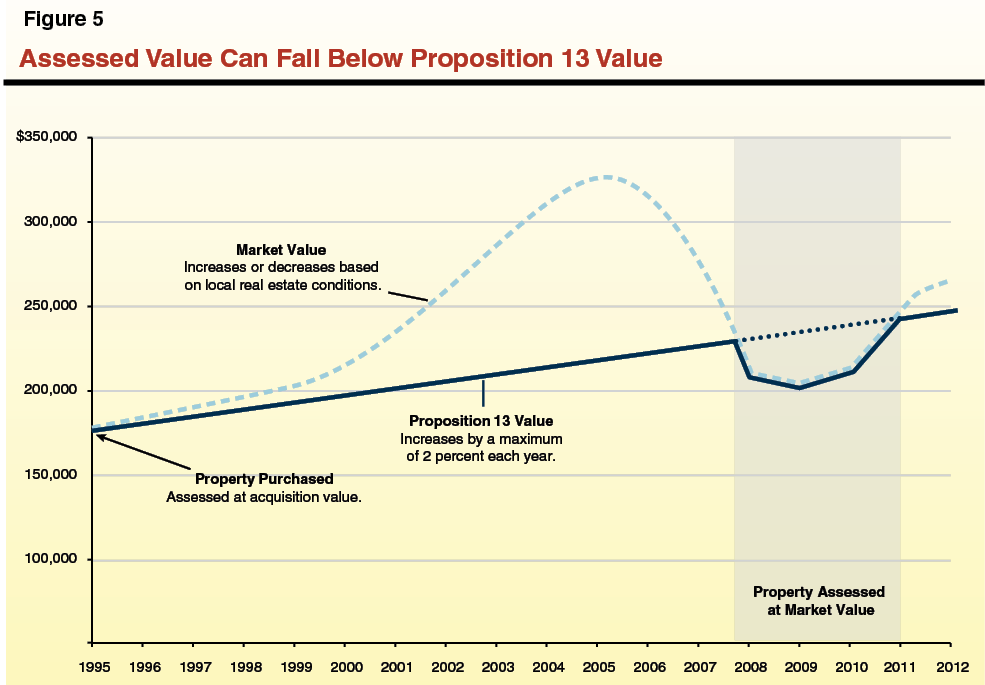

Even though California does not have its own estate and inheritance taxes it is still one of the highest tax states in the country. Some people are unaware that the state of California has a real estate tax and property tax. Theres a 2 cap on this.

However residents may have to pay a federal estate tax. When you sell an asset for profit in California you will be taxed on the capital gain you make. That means taxes are calculated by the value of the home.

These taxes go unpaid if theyre not paid within three years. Heres what to know about estate taxes in California. Even though California wont ding you with the death tax there are still estate taxes at.

California tops out at 133 per year whereas the top federal tax rate is currently 37. This applies to stock bonds real estate cars and most other assets you sell. In California retirement accounts and pension plans are.

The Real Estate Tax Implications Of California Prop 19 Certified Tax Coach

Quick Guide To California Property Taxes Doma

Understanding California S Property Taxes

Prop 13 Offers Higher Tax Breaks For California Homeowners In White Neighborhoods

Residential Real Estate Tax Rates Arizona Real Estate Notebook

California Limits Property Tax Deduction To Well Taxes Firsttuesday Journal

Understanding California S Property Taxes

Buying Out Your Sibling S Share Of An Inherited Home Can Have Expensive Property Tax Consequences In California Snyder Law

Orange County Homes With No Mello Roos Orange County Mello Roos Properties

California Real Estate Tax Information

Learn How California Property Taxes Are Distributed Controller Treasurer Department County Of Santa Clara

Californians Adapting To New Property Tax Rules City National Bank

Tax Lien Properties California Real Estate Tax Lien Investing For Beginners How To Find Finance Tax Lien Tax Deed Sales Blank Greene E 9781081362898 Amazon Com Books

County Of Marin Department Of Finance Where Your Property Tax Dollars Go

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire