putnam county property tax bill

Rates in Jasper County are likewise relatively low. Virginia is ranked 29th of the 50 states for property taxes as a percentage of median income.

Putnam County Georgia Tax Commissioner Facebook

The median annual property tax payment in Jasper County is 899.

. If you would like to research a specific property you may do so using the public access terminals in this office lower level B-1. The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. Putnam County is a county located in the northeastern part of the state of FloridaAs of the 2020 census the population was 73321.

Putnam County comprises the Palatka FL Micropolitan Statistical Area which is included in the Jacksonville-St. Where do I obtain a Letter of. The tax rates are expressed as dollars per 100 of assessed value therefore the tax amount is already divided by 100 in order to obtain the correct value.

The median property tax paid by homeowners in this southern West Virginia County is a mere 482 per year. Click the button to clear results window and map highlighting. Chester Davidson Nashville Hamilton Chattanooga Hickman Knox Knoxville Montgomery Rutherford Shelby Memphis Sumner and Williamson Counties maintain their own sitesLinks to those sites can be found in the Help section.

The countys average effective tax rate is 078. Easily run a rapid Vanderburgh County IN property tax search. Marys-Palatka FL-GA Combined Statistical AreaThe county is centrally located between Jacksonville.

Thats about the national average. The goal of the Putnam County Assessors Office is to provide the people of Putnam County with a web site that is easy to use. You can use the options below to find property based on Parcel Number Owner Name Property Address or Subdivision Name.

Just type in the exact address in the search bar below and instantly know the targeted propertys bill for the latest tax year. North Carolinas median income is 55928 per year so the median yearly property. North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina.

Contact the County Assessment Department Assessor page - 516-571-3442. Looking for FREE property records deeds tax assessments in Orange County NY. Quickly search property records from 30 official databases.

PROPERTY OWNER BILL OF RIGHTS. This section provides information on property taxation in the various counties in Georgia. Our goal is to make this information available as soon as possible but please be aware.

That gives the county a 052 average effective tax rate which is a bit below the statewide average. You can search our site for a wealth of information on any property in Putnam County. The Putnam County Tax Commissioner should be contacted with tax bill related questions at 706-485-5441.

The Monroe County Tax Collector also accepts partial payments with a signed affidavit found on the back of the tax bill or contact our office at 305 295-5070 for a copy of the affidavit per Florida Statute 197374. Fairfield County Property Records are real estate documents that contain information related to real property in Fairfield County Connecticut. The property owner must agree to and understand the following.

Filing a property tax return homestead exemptions and appealing a property tax assessment. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. A renewal of a tax for the benefit of the County of Lucas for the purpose of Mental Health and Recovery Services MHRS and operations of mental health programs and alcohol and drug addiction programs at a rate not exceeding one 1 mill for each one dollar of valuation which amounts to ten cents 010 for each one hundred dollars of valuation for 10 years.

Every effort has been made to include information based on the laws passed by the Georgia Assembly during the previous session. Falls Church city collects the highest property tax in Virginia levying an average of 094 of median home value yearly in property taxes while Buchanan. The LOHE was in effect in Cook County beginning with the 2007 tax year for residential property occupied as a primary residence for a continuous period by a qualified taxpayer with a total household income of 100000 or less.

The exact property tax levied depends on the county in Virginia the property is located in. Click the button for more search options. Documents and Forms Disclaimer.

Its county seat is Palatka. Notice of Certification of the 2021 Tax Rolls. Online versions of Putnam County FL Documents and Forms are posted for your convenience only.

123 N Main St 850 main st ferdinand Walnut St3rd St 19-06-35-102-218000-002 john smith holiday lake kellerville rd mcdonalds Click the button to recall previous search results. Base tax is calculated by multiplying the propertys assessed value by all the tax rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Notice of ReCertification of 2021 Tax Rolls.

Who do I contact for information on the Star Enhanced Star Veterans Exemptions and property assessment. Want to find out what the tax bill is for a specific property. The countys average effective property tax rate is 063.

Located in western Missouri the Cass County average effective property tax rate is 107. The PTELL is designed to limit the increases in property tax extensions total taxes billed for non-home rule. Discounts are extended for early payment.

Basketball Champs Putnam County Georgia

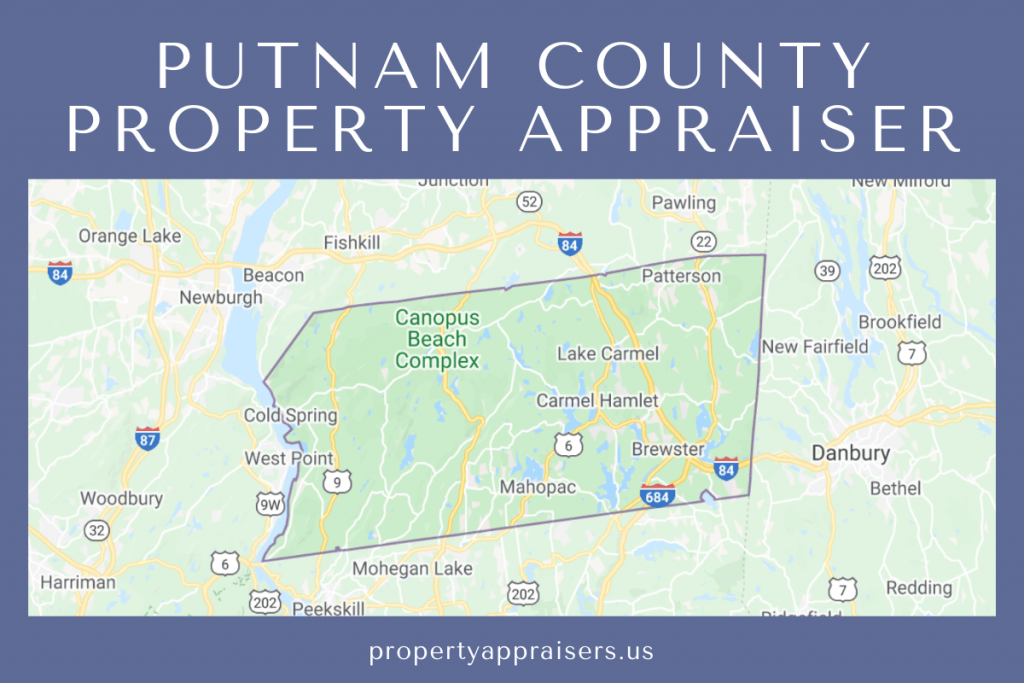

Property Appraiser Putnam County Florida

Putnam County Florida Property Search And Interactive Gis Map

Parcel Search Image Mate Online

Putnam County Property Appraiser How To Check Your Property S Value

Putnam County Assessor Homestead Exemption Credit

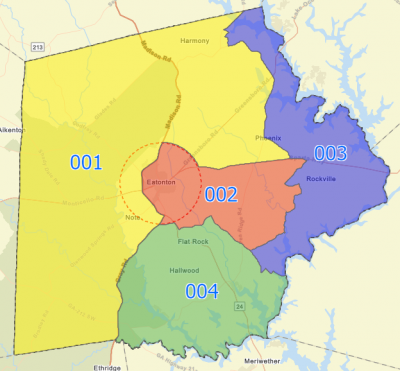

New Commission Districts Putnam County Georgia

Putnam County Tax Assessor S Office

Putnam County Tax Assessor S Office

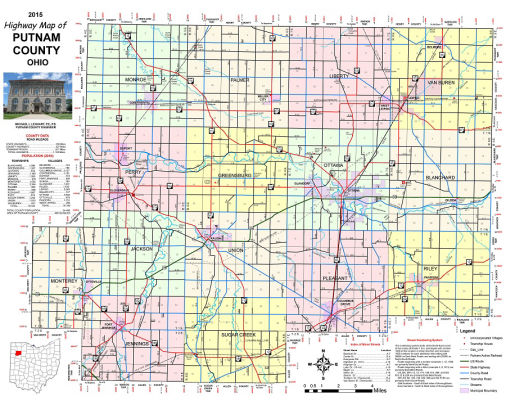

Putnam County Ohio Tax Map Department

Putnam County Tax Assessor S Office

Press Releases For County Executive Archives Putnam County Online

Putnam County Property Tax Inquiry

Capital Improvements Putnam County Fl Bocc